The economic parameters in the whole of the Middle East underwent tremendous fluctuations during the years of the Rashidun Caliphate.

Gross Domestic Product

It is hard to guess if there was any change in the GDP in the total area under the administration of the Rashidun Caliphate. The region was war-ravaged throughout. Initially, there were the Ridda Wars that lastest one year. It was followed by Futuhul Buldan and finally, there was the First Arab Civil War. It is known that war generates uncertainty. Uncertainty is harmful to the economy. The war resulted in many deaths. Definitely, it created a labour shortage in conquered lands where more people died in the war or were taken as hostages to the towns of the Arab Muslims. Due to the threat to proprietorship of property in areas that ultimately fell under the tutelage of the Rashidun Caliphate, people might have been the least interested in saving and investing. Due to the cumulative effect of all factors, the GDP of the region should have been static if not negative. No doubt, the Rashidun Caliphate removed hindrances to free trade by the destruction of international boundaries between distant areas of North Africa and Central Asia. The appearance of its good effects, however, might have needed the establishment of peace.

A shift of wealth from one region to another is obvious. We know the flow of money throughout the three decades of the Rashidun Caliphate remained from conquered regions to cantonment cities and to the capital city due to government taxation and spending policy. Presumably, the standard of living of people in the conquered regions decreased and that of cantonments enhanced. No statistics are available to support assertions. Historians have established that the Christian population of the Arabian Peninsula also enjoyed the benefits of wealth flow in the peninsula. 1

Industries in the Rashidun Caliphate

The Rashidun Caliphate had invaded geographic regions that were at the height of their industrial production at that time. They were more mechanized than in Arabia. Archaeologists have discovered a machine from Jerash in Jordan dating from the late sixth century CE. It was powered by running water and was used to cut stones. These semi-precious stones were used in a decorative outlay of buildings and as paving slabs. 2 This machine should have enough work to remain busy for a reasonable time throughout the year. Otherwise, the investment was not worth it. Such discoveries, actually, challenge our dogma that mass production started suddenly in 12th-century Venice. It was rather a continuous process, sometimes at a fast pace other times slow, going on throughout human history.

The sawmills discovered at Jurash.

Tabari describes a similar water mill used for the same purpose i.e. cutting stones at River Murghab in Khorasan.3 It gives us the impression that Sasanian Iran was as economically developed as Byzantine Rome.

Machines do not necessarily provide us with spare time. It essentially increases production. A truck driver is as busy as a camel driver. However, a truck driver produces more than a camel driver. The use of machines for mass production in Byzantine Rome and Sasanian Iran and their absence in Arabia suggests that the per capita income of both those countries was higher than that of Arabia before Futuhul Buldan.

The basic industry all over the Middle East was food production. Swad, for example, had extremely fertile land, coupled with an extensive canal irrigation system. 4 The production of wheat, barley, Indian Peas, grapes, cucumbers, sesame, dates, and sugar cane are well documented for Swad. 5 The total agricultural land in Sawd was sixteen million jarībs. 6

The mining and metallurgy industry never lagged behind. Historical sources for that time keep us updated. Baladhuri mentions mining in as central locations as Iraq and as far-off locations as near the city of Majjānah in Ifriqiyah. 7 The mining industry continued to thrive and flourish in Arabia as well. 8

The Middle East was the hub of international trade. All of the manufactured materials and raw materials from the East or West passed through the Middle East. The Middle East was itself the main consumer of traded products. The transport industry was well developed in the regions. Camel trains, which were equivalent to modern goods trains, regularly passed on the highways. Governments assured the safety of highways. Iranians used camels to transport treasure from Tswyn to Armenia.9

Slavery

The Rashidun Caliphate upheld the centuries-old institution of slavery in the Middle East. Forcing somebody into work without paying market-related wages is slavery. 10 Laws pertaining to property have to be applied to humans to practice slavery. 11

The society of the Rashidun Caliphate had two kinds of slaves. One was industrial slaves. The other was domestic slaves. 12 Industrial slaves worked the whole of their life in all kinds of industries. They were the least expected to get manumission. Some of them, mainly working in trades and earning good money, might have been able to save enough money to buy their freedom. The domestic slave most commonly got their manumission. They were physically and emotionally near their masters. Hard work and loyalty could earn them freedom.

Businesses were not only utilizing those slaves whom forces of the Rashidun Caliphate had captured from their foes, but they also imported them from overseas. The main source of overseas slaves was Africa. One of the conditions of the contract with the people of Maghreb after their defeat in war at the hands of Amr bin As was to sell slaves to the Rashidun Caliphate at a fixed price. 13 The Rashidun Caliphate contemplated similar benefits in its trade agreement with Nubia. 14

There is a clue that household slavery was on a decline in Byzantine Rome and was later restricted to the wealthiest strata of the society.15. There is some evidence that industrial slavery also declined in late Byzantine Rome. It could have resulted from an economic recession. 16 It appears that slavery started thriving again after Futuhul Buldan.

The clash of interest between business owners and their slave labourers was profound among the industrial category of slaves. During the Caliphate of Umar, Muẓahhir bin Rāfi’ brought ten Christian slaves from Syria to work on his property in Khaybar. Those Christians killed him in anger that they belonged to the land of wine and goodness but were made to work in strenuous conditions. 17

The supply of slaves definitely increased for Muslim business owners during the Rashidun Caliphate due to unstoppable wars. Certain villages of Egypt resisted and Amr bin As carried away their inhabitants as prisoners. They were sent to Medina. Umar sent them back and made them dhimmis together with other Copts. 18

Slaves fought in wars from the side of their masters. They didn’t get a dime from the booty. Their only remuneration was the ration provided to them by their masters.19

Somewhere down the road, the Rashidun Caliphate amended the slavery law. Umar made it illegal for an Arab to keep another Arab in slavery (particularly Muslim). It applied to both men and women slaves. The only exemptions were those women who had given birth to a child to their master. The remaining slaves were not released for free. Relatives of each of them had to pay from four hundred and twenty to four hundred and ninety Dirhams per slave. Umar was particularly gentle to Hanifa and Kindah because a number of their men had died in the war. They could pay a lesser amount. Those who could not afford even that nominal charge were allowed to give lesser than the regular amount. Giving his arguments for this development, Umar said that the Arabs had conquered non-Arabs and they had grown rich. 20, 21

Infrastructure for economy

Nobody has the slightest doubt that infrastructure is essential to tap any kind of economic resources. The Rashidun Caliphate was engaged with building and maintaining essential infrastructure from the beginning. The subjects of the Rashidun Caliphate, inclusive of Jizya paying non-Muslims, expected their government to attend to the infrastructure of the country. The dehqans of Anbar, for example, asked Sa’d bin Waqqas to dig a canal to increase irrigation to their farms.22 The Rashidun Caliphate dug new canals in Khuzestan to bring new virgin lands under cultivation soon after its occupation.23

Maintaining communication pathways by keeping highways in good shape and reducing distances by constructing new pathways was a priority for the Rashidun Caliphate. It would have helped both military and civilians. The construction of new bridges in Swad started during Umar’s tenure. 24 Uthman’s government completed a major infrastructure project when it constructed a bridge on River Euphrates at the spot of Manbij (Qal’at an Najm).25

Construction of infrastructure facilities in and around the capital Medina, like damming waters of Mahzūr torrent to protect Medina from flash floods during Uthman’s caliphate was natural for Rashidun Caliphate. 26 Actually, Umar’s government spent disproportionately on infrastructure in Hejaz. Umar permitted the building of road stations between Mecca and Medina in July of 638 CE.27

The central government was responsible for the maintenance and development of infrastructure only in those provinces that were under its direct rule. The contract with ex-Iranian provinces that came under the influence of the Rashidun Caliphate after the Battle of Nahavand specifically stipulated that they were responsible for their own infrastructure. 28

Interestingly, the Rashidun Caliphate dug a waterway connecting the Mediterranean to the Red Sea to bring food from Egypt to Medina in 639 CE. According to Tabari, Byzantine Rome had dug it in 610 CE. They made it unusable with the help of Copts.29 Probably, the Romans did it in preparation of the defence of Egypt.

Natural disasters

Natural disasters not only cause loss of human life, but they are also detrimental to the economy. Each country has its own ways to handle them. Medina and its surrounding districts had a severe drought (ramādah) and famine in 639 CE. Caliph Umar took his people outside the town to pray for rain. 30 Umar’s government explained the drought on account of alcohol drinking among Muslims in Syria.31

In 640 CE Ḥarrat Laylā, got engulfed in fire. Umar ordered giving alms, whereupon the fires went out. 32, 33 In 641 CE there was such a disastrous earthquake that it was worth noting for early Islamic sources. Ya’qubi reports that nobody had ever witnessed such an earthquake before. 34

Nomenclature of taxes in Rashidun Caliphate

Islamic sources for this period of history differ about the proper names of the taxes. It appears that the name of a particular tax differed at the time of writing from what it originally used to be. Let’s examine the name of taxes given by Baladhuri. Baladhuri informs us at one place in his monograph that the People of Ḥamāh paid Jizya (Jizyah جِزيَه) on their heads and Kharaj (kharāj خَراج) on their lands. 35 Here clearly, Jizya was the name of the poll tax, which non-Muslims used to pay and Kharaj was the name of the tax which non-Muslims had to pay on their agricultural income. At other places, anyhow, Baladhuri uses the word kharaj for the poll tax. He tells non-Muslim Inhabitants of Homs, had to pay Kharaj.36 Here Baladhuri confuses Jizya with Kharaj. Occasionally Baladhuri uses the word tasq (ṭasq طَسق [tax]) instead of Kharaj to make the nomenclature of taxes more confusing.37

Similarly, Baladhuri tells that either zakat (zakāt زَكوٌة) or kharaj could be taken, not both, depending upon the land.38 It means zakat and kharaj both were taxes on agricultural land. Which one of them was applicable to a specific parcel depended upon the religion of the owner. Hence zakat was a tax on a Muslim’s land. We hear that during Prophetic times, what Muslims of Arabia used to pay was only sadaqah (ṣadaqah صَدَقَه).39 The same tax, sadaqah, appears to have changed its name to Zakat during Rashidun Caliphate. During the Ridda Wars, Abu Bakr insisted on payments of Zakat, not sadaqah. Citation. Sadaqah became some kind of alms which the state collected from rich Muslims and gave to poorer Muslims during the Rashidun Caliphate. 40 Later on, it appears that even zakat changed meanings. The word Ushr (‘Ushr عُشر [tithe or tenth]) became fashionable to designate the tax which used to be zakat. 41 Due to the complexity of nomenclature, this text tries to name a tax by the gist of it, rather than by its proper name. 42

Tax structure of Rashidun Caliphate

The taxation law of the Rashidun Caliphate was complex. It levied different kinds of taxes on different groups of citizens. All non-Muslims had to pay taxes. They used to pay two types of taxes. One was a poll tax (jizya). It was collected from and imposed on each household. The man, being the head of a family, was responsible for paying it. He paid it from his work income, whether from a business or labour.43 The other type of tax was a land tax (kharaj). It was levied on non-Muslim landowners. Muslims generally paid two types of taxes. One was income tax (sadaqah) which each household paid for its income, either from a business, labour or agricultural, but generated without the help of the state. The other was a land tax (zakat/tithe/ushr). It was levied on those lands that the government had allotted to Muslims. Voluntary almsgiving (khayrāt خَيراة) was extra and was not a part of the tax system.

Soldiers, who had participated in a single battle, were exempt from any kind of tax. The same was the rule for anybody who had strived along with Prophet Muhammad to spread Islam.

All taxes mentioned above were levied upon citizens of the Rashidun Caliphate. When a state collects tax from its citizens, it automatically creates an obligation towards them. That is the protection of their lives and property. In the case of the Rashidun Caliphate, it used to collect a special tax from certain non-citizens. This was war indemnity/war reparations, called fidya (fidyah فِدِيَه). People of Cyprus used to pay for it but their life or property was not protected by the Rashidun Caliphate.44 Probably people of Ifriqiyah also fell under this category.

Rate of taxes

A high yield farm of the Swad

Knowing the exact rate of taxes is even more difficult than knowing the names of taxes. The rate of tax differed from community to community and from province to province. It also kept changing throughout the years of the Rashidun Caliphate.

The rate of poll tax (jizya) mainly depended upon how that particular community surrendered, after a fierce war or in response to a notice. It also depended upon their paying capacity.

Initially, when the Muslims started Futuhul Buldan, the rate of the poll tax was flat for the whole community. Later on, amendments in taxation law created tax brackets for different income groups. For example, originally, the poll tax for everybody in Syria was ten Dirhams and one jarib (Jarīb جَرِيب) per head annually. Umar bin Khattab later changed it to three tax brackets, one for the poor, one for the middle class, and one for the rich. The richest had to pay forty Dirhams annually. 45, 46

The Rashidun Caliphate kept reviewing the rate of poll tax so it should be within paying capacity of taxpayers and they should not be discontent enough to default tax payments. When Uthman came to know that the Christians of Najran living in the district of Kufa had difficulty paying their agreed poll tax, he reduced it.47 Umar imposed more poll tax on the people of Syria as compared to those of Yemen because the former had the means to pay it. 48 The rate of poll tax didn’t depend upon the kind of religion a non-Muslim held. The Rashidun Caliphate didn’t grant Arab polytheists the right to live. They had to either convert or die. All other religions were welcome to survive and thrive provided they paid poll tax. Umar extracted a poll tax from the Zoroastrians of Persia and Uthman extracted it from the Berbers. 49

The rate of Kharaj depended upon the income of the land it was levied upon. The rate of Kharaj on every jarīb of land that produced thickly sown wheat was one and a half Dirham in Swad. It was one Dirham per Jarib for the land that produced wheat not so thick and not so thin. For a thin wheat-producing farm it was two-thirds of a Dirham. 50 As the price of the finished product of the land varied, so did the rate of Kharaj. It was half a Dirham for one jarib of barley in Swad. In the case of a palm tree, it was ten Dirhams if the tree was in an orchard but nothing if the palm tree was outside a village and passersby could easily eat its fruit. Side crops, which usually the farmers grew for personal use, like vegetables, sesame or cotton didn’t require any kharaj. 51 In addition to this basic Kharaj that everybody had to pay, there was additional kharaj on the rich similar to the modern wealth tax. Every landowner had to pay twelve Dirhams per head each year. Medium-sized landlords had to pay twenty-four Dirhams per annum. Those who could afford a mule and used to put up a ring around their ankle made up of gold had to pay forty-eight Dirhams per year.52, 53

Kharaj was assessed on the quality of land and its ability to produce. The owner of the land had to pay it even if he kept it uncultivated. 54 At one place Ya’qubi gives the rate of kharaj in Egypt in percentage. It was two irdabbs of wheat for every hundred irdabbs of wheat produced, i.e. 2%.55 Naturally, as mentioned above, there was also the other kind of kharaj which farmers had to pay. Kharaj was not only applicable to agricultural farm income but also to mills working in rural areas.56done1

The rate of Muslim income tax (zakat) varied widely and it depended upon the profitability of a business. The income tax on Muslims on mining income was twenty-five percent per year.57 On the other hand, on agricultural income, like honey, it was only ten percent per year.58

Probably, the rate of Muslim income tax (sadaqah) remained the same as it was during the Prophetic times. Apparently, this tax became non-significant, as the overwhelming majority of Muslims had taken jobs in the military, abandoning all other kinds of economic activities. Many others had government-allotted lands and fell under the category of zakat.

The tax could be paid in cash or in kind. The people of Najran living in Kufa used to pay their poll tax in the form of readymade garments. 59 The people of Syria and Jazira had a choice to pay in cash or in kind. In the case of in kind, it was two modii of wheat and three qisṭs of oil per month. They could also replace wheat or oil with honey or grease.60 If the people of Egypt chose to pay by in kind, they could pay one irdabb (of wheat), clothing and entertain one Muslim as a guest for three days. 61

Tax collecting apparatus

All tax assessors were Arab Muslims. Tax assessors of big revenue-generating units were directly responsible to the caliph. The small revenue-generating units were responsible to the relevant governors.

Tax collectors were from the local people. The Rashidun Caliphate did not disturb the existing systems of tax collection in each and every land they reached. In the case of the Arab population, even for non-Muslims, the tribal chief was the tax collector. It was his duty to collect due tax from each and every household of his tribe, which could be scattered all over the country. Then, he transferred the amount collected to the tax assessor and the governor. They, in turn, sent the money to the central government. The chief of the Najranis at Kufa used to send his messengers to all the people of Najran who were in Syria and other districts and to gather money assessed evenly on them for raising the required robes as tax. 62 Dehqan used to play the role of tax collector for the communities of ex-Sasanian Iran. Headman had a similar role for the communities of ex-Byzantine Rome.

Volume of tax revenue

The statistics surviving the distance of fourteen centuries between the Rashidun Caliphate and us give only hints about the volume of tax collection.

The tax revenue generated by rich cultivated provinces was much higher than that generated by relatively barren provinces. Egypt, which was the richest province and probably most heavily taxed, used to generate one hundred and forty million Dirhams annually. 63, 64, 65 The province of Homs, which later became a district of wider Syria, used to pay one million and seven hundred thousand Dirhams annually. 66, 67 Tax revenue of Swad was a hundred million Dirhams.68 Bahrain used to pay total tax revenue of seven hundred thousand Dirhams per year.69

About eighty percent of the revenue generated by the Rashidun Caliphate came from Non-Muslim land tax (Kharaj) on agricultural lands. The total revenue in the case of Swad was a hundred million Dirhams. 70 Out of this, eight million Dirhams came from Non-Muslim land tax on agriculture. 71

Nonpayment of taxes

Like in all times and countries, paying annual tax was not a pleasant celebration for the people. The government had to squeeze it out of them. Umar wrote to his governor of Taif that if people do not pay zakat on their honey, the government would not protect the titles of their property. 72 This meant if somebody encroached on the property of a person in arrears of taxes, he shouldn’t expect government police to evict the encroacher.

During his return to Medina, while still in Syria, Umar encountered men who had been lined up to be punished for nonpayment of Kharaj. Umar spared them.73 The ruler of the Rashidun Caliphate had the power to waive anybody’s tax.

Government spending

The biggest expenditure of the central government of the Rashidun Caliphate was on the salaries of the military. Soldiers received remuneration for past performance in a war. All soldiers were veterans now. Heavy payments to military personnel left very little for the Medinite Government for other expenditures of a normal government like maintaining highways, developing economic infrastructure, disaster management, and similar duties. The central government of the Rashidun Caliphate always remained cash-strapped. That is the reason Ali insisted on the returning of dues.74

Ya’qubi asserts that the government recycled all the tax money it collected from non-Muslims, including poll tax and Non-Muslim land tax, in ‘aṭā’.75 The only funds the Rashidun Caliphate could spend on other government expenditures came from tax revenue collected from the Muslims.

Some non-combatant Muslims received ‘aṭā’ as well. Their portion depended upon many factors including physical nearness to the Prophet, participation in the spread of Islam, and current significance for the state. According to statistics from 641 CE provided by Ya’qubi, top earners among the noncombatants were widows of the Prophet. They were not on equal footing. Most of them received six thousand Dirhams each annually; three of them, Aisha, Umm Ḥabībah and Ḥafṣah received double the amount at twelve thousand each; and two of them, Ṣafiyyah and Juwariyah, received lesser at five thousand each. The Quraysh origin of the higher group and the slave origin of the lower group explain the difference. Then came Banu ‘Abd Manāf. There was a ranking among them as well. Ali bin Abu Talib’s stipend was five thousand Dirhams; his sons Hasan and Husayn received three hundred each. Abbas’s stood at three thousand; The leaders of late converts from Mecca who had played a vital role in the Ridda Wars and Futuhul Buldan fared well. Abu Sufyan and his son Mu’awiya both got five thousand each. Ansar participants of Badr got four thousand each and Muhajirun participants of Badr got three thousand each. Those Muhajirun who had immigrated to Ethiopia and did not return until the subjugation of Khaybar received only six hundred or seven hundred Dirhams each. All other Quraysh were junior to them. Noncombatants from all over Arabia received ‘aṭā’ but at variable rates. Each man from Yemen got four hundred Dirhams each annually, Mudar three hundred each and Rabi’a two hundred each. Umar had nominated a three-member standing committee of expert genealogists consisting of ‘Aqīl bin Abu Ṭālib, Makhrama bin Nawfal, and Jubayr bin Mī’im. It was their responsibility to include each possible person in the register. The committee had named Umar and his family at the top, initially. Umar objected that being a caliph is not as honourable as being a relative to the Prophet. He put Banu Abd Manaf on top. Umar received four thousand and his son Abdullah received five thousand Dirhams annually. The stipend was for the individual and not for the whole household. Certain women qualified to get a stipend. Asmā’ Bint ‘Umays, Umm Khuthīm bint ‘Uqba bin Abi My’ayt, and Khawal bint Ḥakīm bin Awqaṣ, the wife of ‘Uthmān bin Maẓ’un received two thousand Dirhams annually. Umm ‘Abd received fifteen hundred Dirhams. Each dehqan convert, who had taken advantage of Umar’s financial scheme, used to receive two thousand Dirhams annually. 76

Properly documented economy

The Rashidun Caliphate had a large volume of revenues coming to the government and similar large volumes of government spending. Umar, who was very sensitive to corruption, insisted on record-keeping. The Rashidun Caliphate took enormous pains to document the economy at the people’s level. A lot of monetary transaction documents were written during that period and have survived archaeologically as proof.

Papyrus PERF 555 is preserved in Austrian National Museum, Vienna. It was written on December 26, 642 CE. It is a letter from military commander Abdullah to the provost of Sophtus, Egypt requesting the sale of fodder and meals to Muslim cavalry for three gold pieces. 77

Papyrus PERF 557 of the Austrian National Museum, Vienna is a similar document dated January 26, 643 CE. Again military commander Abdullah asks two Pagarchs of Herakleopolis, Egypt to pay a certain amount of provisions to his soldiers which is probably part of their Jizya.78

Papyrus PERF 558 of the Austrian National Museum, Vienna is a receipt of receiving provisions from those two Patriarchs of Heraklepolis by Abdullah the commander on April 25, 643 CE.79

Land survey

A well-documented economy cannot come to fruition without the proper documentation of resources. As expected, Umar did an extensive survey of the lands he was governing. He sent ‘Uthmān bin Ḥunaif of Ansar to those areas of Swad that lay below Tigris and Hudhaifah bin Yamān to those areas of Swad that lay above Tigris, for example. These officials surveyed all land up to the mountains of Huluwan to the lower part of Euphrates.80

Population Census

The Census of the labour force goes hand in hand with the documentation of available resources for a government to develop appropriate fiscal and economic policies. Baladhuri notes that Umar had taken a census.81 Theophanes the Confessor adds that in 640 CE Umar ordered “his entire domain registered: there was a census of men, flocks, and agricultural products.” 82

Calendar

Arabs did have their own calendar during pre-Islamic times with proper names for twelve months. Its reference year of start was not universally accepted. Each community used any event specifically important to it as a reference year. A big economy, like the Rashidun Caliphate, could not depend on this arrangement. A government-backed calendar was needed for the timely collection of taxes, signing the length of contracts between parties, planning of events, and many more things. The Middle East had many calendars in use. The Iranian calendar, which used the year of the ascension of the current king as a reference year and the Roman calendar that used a tax cycle as an indication are a few instances. None of them was very practical. Rashidun Caliphate needed an official calendar for government work. Umar designated the first day of the year in which Prophet Muhammad immigrated to Medina as the starting day of the Muslim calendar. This calendar, called the Ḥijrah calendar, was launched in April of 637 CE. 83 Soon it became the only official calendar for the Rashidun Caliphate and many other countries to come.

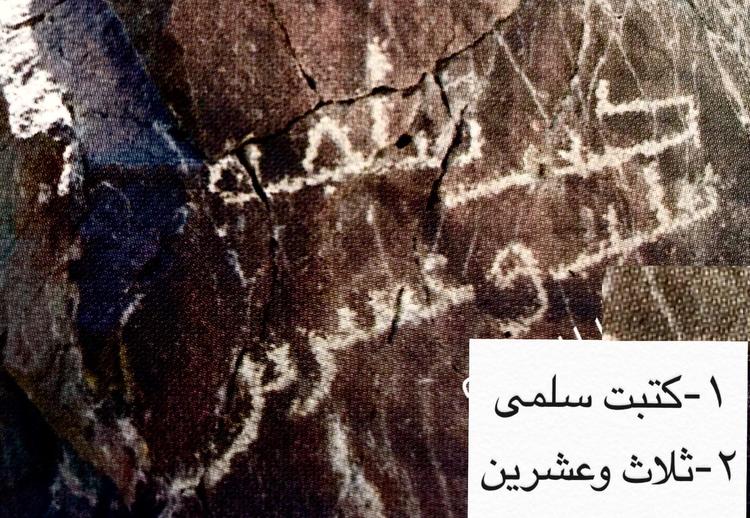

A twelve-centimetre into five-centimetre-sized extremely fragmented papyrus is preserved in Staatsbibliothek in Berlin. It is some kind of debt acknowledgement. The year written on it is twenty-two. This is the earliest documented use of the Hijrah calendar.84 Not only at the official level, but people at the ground level also received it with open arms. An inscription at Muthallahth near Yanbu in Saudi Arabia simply states, “Salamah wrote in twenty-three”. 85

Muthallahth Inscription. 86

Coinage

Each country issues its own currency to fully control economic activities going on within its financial borders. Rashidun Caliphate had conquered two countries with their own currencies. Soon it tried to establish a currency of its own, with an expectation that it would gradually replace the coins of its predecessor governments. 90 However, attempts to introduce Rashidun Caliphate’s own currency was half-hearted, clumsy and totally local. The central government did not show any inclination toward it. It kept both Sasanian currency and Byzantine currency acceptable. It continued the production of Sasanian Dirham in government mints. However, it did not produce any Byzantine Dinar. All were imported from Byzantine Rome.91

An Arabic-Sasanian coin with word Jayyad in Arabic on the margin. 92

Measurements

In well-performing economies, government standardizes and regulates measuring scales. In the case of the Rashidun Caliphate, it appears, it never got time to attend them. Arab Muslims left the measuring scales of occupied countries untouched. They tolerated differences in measuring scales used in different parts of the same country very well. They based the measurements needed for government purposes on a measuring scale already in use in that particular region. One scale to measure distance used in certain areas of Byzantine Rome was Parsang. Baladhuri records that Cyprus was eighty Parsang long and eighty Parsang wide.94 It gives us a clue that a Parsang should be around eight hundred meters. The measuring scale for length in ex-provinces of Sasanian Iran was Dhirā’. It is usually translated into English as Cubit. Baladhuri informs it was equal to the length of a man’s arm, hand and thumb stretched out.95 Modern historians consider it to be 54.04 inches long.96 The measurement of bigger weights in certain parts of Sasanian Iran was in Qafīz.97 Another weight measure was called Shāburqān and was equivalent to Makhtū al Ḥijjāji.98

Salary level of government servants

The government used to pay peanuts to its administrative servants. The salary of ‘Uthmān bin Ḥunayf, the surveyor of Swad was five Dirhams daily and a leather bag of flour. 99 Abu Bakr used to draw a fixed salary of three Dirhams per day from the state exchequer.100 (Approximately eleven hundred Dirhams per annum).

Contrary to this, the remunerations of a soldier were lavish. He could grab whatever he could on the battlefield. This payment was called booty (ghanīmah). Its amount depended upon the relative wealth of the defeated enemy and the number of soldiers participating in the fight. Each cavalryman got fourteen thousand Dirhams and each infantryman got seven thousand and one hundred Dirhams from the booty of Qadisiyyah. 101, 102 In addition to the booty, a soldier and his generations were entitled to get an annual share of the tax revenue from the lands he helped in conquering. It differed, again, depending upon the wealth of the people of the land conquered and the number of soldiers who helped in conquering the land. In the case of soldiers who participated in Qadisiyyah, it was three thousand Dirhams per year.

Government interference in markets

In 639 CE Umar’s government received reports that prices of essential goods were on the rise. The government found out that people had started hoarding. Umar, therefore, promulgated a law banning hoarding. 103, 104 This is a classic example of government interference in the market process. No government is immune to it. A government has to act to protect the most vulnerable in society. Otherwise, it stands a chance to lose people’s mandate.

The Rashidun Caliphate devised liberal economic policies with the least intervention in markets. We never hear of fixing goods prices, guaranteed minimum wages, the compulsion to buy labour from certain quarters, quotas in the job market, bankruptcy protection, tax holiday, or a ban on imported goods.

Interest-free economy

Non-Muslims were allowed to run their economies according to their own religious beliefs. They might have been allowed to pay and charge interest. Muslims were barred from this practice. Who in the private sector would lend money under these conditions? Probably, Muslims had no option except to ask their affluent relatives and friends for loans. The public treasury came forward to provide lending services to Muslims. We hear many names, like Umar, Sa’d bin Waqqas and Hindah bint ‘Utbah who borrowed money from the public treasury.105 In the case of Hindah, she used it to start a personal business. In the case of Umar and Sa’d bin Waqqas, they probably used it for personal needs. One tribulation of lending interest-free money from the government exchequer was that people refused to pay back and tried political manipulation to get their loans written off. Both Sa’d and Hindah did it. In any case, the government was not amenable to such pressures. Finally, everybody repaid their debts. 106

Some individuals were richer than others

Even if the economic system provides equal opportunities to individuals, certain individuals perform much better than others do. The differences in the economic status of individuals started growing soon after immigration. Let us illustrate this point from the example of Abdur Rahman bin Awf and Ali bin Abu Talib. Both were immigrants. They might have left their houses and wealth behind in Mecca even if they had any. In the end, when Abdur Rahman bin Awf died in 653 CE, his net worth was thirty-two million Dirhams, about forty-five times more than the annual tax revenue from the whole of Bahrain. 107 Islamic sources don’t mention any occasion when the state assigned any fief to Abdur Rahman bin Awf. He generated his wealth all by himself.

Ali received fiefs from the state. Baladhuri notes that Prophet Muhammad allotted him four parcels of land. Two of them were in Fuqairs, one was at Bi’r Qays and one was at Shajrah.108, 109 Caliph Umar allotted him a fief in Yanbu.’110, 111 Still Ya’qubi reports that Ali had been reduced to poverty at the time of his death.112

Jean-Philippe Bouchaud and Marc Mezard have done interesting research. They used a computer to produce as many different possibilities of random gains and losses as possible for a group of people who had equal wealth at the beginning. They showed end result was always a Pareto curve.113 The research demonstrates that the money will eventually concentrate in a few hands whichever way it flows. Mark Buchanan attributes it to human psychology. He asserts that the richer you are, the lesser afraid you are of losing a few bucks. 114 The rich take financial risks easily. Due to their risk-taking behaviour, the richer would grow further rich. The only question is who would be those lucky ones who are the top wealthiest? They are those who have the attributes of a successful entrepreneur. In this analysis, everybody was equal initially. Those who got slightly rich than others got better returns on their investment by luck. Once that person gets slightly richer, and others slightly poor, he has more chance of opening a business, building a house, or taking a holiday. In each case, either wealth flows towards him or away from him. Meaning, he remains in the network. On the other hand, those who are relatively less affluent tend to avoid building a house, opening a business or taking a holiday. Money does not flow out of them or towards them. They tend to get out of the network. Jean and Marc found that the disparity between rich and poor would eventually develop whatever the economic system, but its depth would differ in different economic systems. The greater the volume of money flowing through the economy and the more often changing hands, the more equal the people are. The more volatile the investments returns, the richer tend to get richer. Higher-income tax tends to erode inequality provided it is redistributed in an equal way. Capital gains tax further reduces inequalities by providing a negative stimulus for the richer to invest. Sales tax increases inequalities because it reduces purchases and hence total transactions. The government policy of deregulating the market results in more investment and more flow of money between a few individuals. In this model, government deregulation leads to the worsening of inequality.

Futuhul Buldan opened opportunities for the entire Arab population. Few could multiply their wealth. The Rashidun Caliphate did not intervene to reduce the gap between the rich and the poor. Initially, Umar did not allow the public manifestation of wealth, which would have created an illusion of equality among Arabs. Uthman was not against showing off wealth. “No man had done this [building lavish houses] during the time of Umar,” informs Ya’qubi, “They did it only after him.” 115

The disparity in wealth might have stimulated a race to be rich during the second half of Uthman’s tenure and might have contributed to the start of the First Arab Civil War.

State-sponsored social assistance

No matter the economic system of a country, some people manage to become poor. The Rashidun Caliphate was self-sufficient with them. Many of them were Muslim Arabs, who otherwise were entitled to government-paid welfare (‘aṭā’). Closing its eyes from the plight of the abject poor can be politically perilous for a government. In 639 CE, Umar appointed food allowance for the dependents of certain Muslims and ordered that the expenses of foundlings and their nursing should be paid from the treasury. 116 The government had to help out the non-Muslim poor as well. Umar bin Khattab, on his way to Jabiyah in the province of Damascus, came across certain Christians who were suffering from elephantiasis (mujadhdhamin). He ordered that they be given something out of the sadaqah funds.117 The Muslim income tax used to generate sadaqah funds.118

It appears that Rashidun Caliphate did not design any permanent and comprehensive social networking. Measures of such social assistance were ad hoc and reactive. If Umar had not encountered those poor mentioned above, they would not have received anything from the government. There were no allocated funds in the budget. Umar had to redirect some other kind of money in both instances.

Gift exchange

No society functions without gifts. Gift giving is a cute gesture to express love. People of equal social ranking come closer to each other by its use. 119 The problem is a gift can be bribery when the value of a gift is substantial or when a socially junior gives it to a socially senior. The rulers of the Rashidun Caliphate were cautious in accepting valuable gifts. Once, Sāriyah bin Zunaym, a field commander of the military of the Rashidun Caliphate in Darabjird, sent a precious stone set nicely in a casket from the booty as a personal gift to Umar, with the consent of the participating soldiers. Umar rejected it with disgust and rebuked the carrier of the gift in utmost anger. 120, 121 It doesn’t mean Umar was ignorant of social cues. He happily accepted a sweet made from a date mix sent to him by ‘Utbah bin Farqad, the lieutenant governor of Azerbaijan in 642 CE.122

Sometimes, the Caliph granted a gift out of joy. Umar bestowed eight hundred Dirhams each upon those who broke the news of triumph in Qadisiyyah to him. 123

This event of gift exchange might be interesting: The first lady during Umar’s tenure, Umm Kulthum (Umm Kulthūm ام كُلثُوم), the daughter of Ali, “sent to the Empress of the Byzantines perfume, drinking vessels and cheap receptacles used for women’s things. She inserted this into the official post (al-barīd), which conveyed it to her. [This material] having been taken from the post, the wife of Heraclius came and assembled her women, saying: “This is a gift from the wife of the King of Arabs and the daughter [sic] of their prophet.” She entered into correspondence with [Umm Kulthūm] and requited her in kind by sending her gifts, among them a superb necklace. Now when the official post brought [these gifts] to ‘Umar, he ordered them to be seized and summoned [the people] together to pray. When they had assembled, he prayed two rak’ahs with them, and then said, “There is no good in any affair of mine that is decided without consultation. What about the gift that Umm Kulthūm sent to the wife of the Byzantine Emperor, who then sent a gift to her?” Some said, “It is [Umm Kuhthūm’s] along with what she [already] possesses. The Emperor’s wife is neither under a pact of protection (dhimmah), so that she should try to conciliate [you] with [this gift], nor is she under your authority so that she should fear you.” Others said, “We used to send garments as a gift in order to get something in return; we would send them to be sold and to obtain a [certain] price.” Then, ‘Umar said, “But the envoy was the envoy of the Muslims, and the postal service was theirs. The Muslims are vexed [to see] [the necklace] on her breast.” Thus, he ordered it to be returned to the public treasury, while he paid (Umm Kulthūm) the amount of her expenses. 124, 125 As Tabari bundles this story with events of Umar Heraclius diplomatic parleys, it could be from that year.

Food supply to Medina

The food supply in Hejaz has been a problem in Pre-Islamic times. After the surrender of Alexandria, Umar requested Amr to establish a food supply line from Egypt to Hejaz. Amr sent three thousand irdabbs of food to Medina on twenty ships. When they reached the port of Jār, Umar personally inspected the ships and built two storehouses (qusūr in Arabic but apparently they were warehouses) to store the food. Then, Umar appointed Zayd bin Thabit of Ansar to register the people according to their standings and write them vouchers of papyrus (ṣikāk min qarāṭīs) and seal them at the bottom. 126, 127 Devising paper vouchers and sealing them on the bottom was Umar’s personal innovation, according to Ya’qubi. 128, 129

The price of food dropped in Hejaz to the level of Egypt when the food supply from Egypt was established unhindered. 130 The price of food in Hejaz must have skyrocketed during the last years of Uthman as the Egyptian rebels blocked the supply route.

Nationalization of lands

Umar confiscated all the pieces of land in Swad that 1) were covered with woods, 2) covered with marshes, 3) were the property of Kisra and his family and appropriated by Kisra, 4) the district Dair Yazid, 5) the land of those who were killed in the war (from Iranian side), and 6) those who had fled the country. 131 The total market value of land confiscated by Umar was seven million Dirhams.132

Rashidun Caliphate applied the same policy everywhere in the conquered lands. 133 The state would have gathered a significant portion of agricultural land in this way. It used the income of these lands to run government expenditures. It also allotted these lands to Arab economic immigrants and to its political dignitaries whenever deemed necessary.

Designation of land use

The practice of designating land for specific use continued during the Rashidun Caliphate. It is always hard for governments to compel people to stick to the designated use of land. The same was the case of the Rashidun Caliphate. The Hima of Rabadhah existed from pre-Islamic times. After many impolite appeals from the people of the district, Umar was compelled to allow small grazers there. In his revised orders, he said that only big flocks like those of Uthman or Abdur Rahman bin Awf were not allowed in the hima.134 Umar successfully kept water and fish from Lake Ṭirrikh in Armenia for public use. 135

Allotment of estates

Governments control the behaviour of their subjects through taxation and monetary policies. Umar not only nationalized many parcels of land in conquered countries, he also allotted many of them to common Arab people. 136 This way, the Rashidun Caliphate encouraged the original population of mainland Arabia to immigrate out of it and settle in newly acquired provinces.

Umar also allotted a piece of land out of nationalized properties to any Arab who was originally a resident of conquered countries, and who accepted Islam. 137 This was Umar’s encouragement to promote Islam among non-Muslim Arabs of conquered countries. He didn’t extend similar concessions to non-Arab non-Muslims.

The government imposed two conditions at the time of allotment of land to common Arabs. The owner had to maintain the land cultivated and he had to pay Muslim land tax (zakat/tithe).138

Umar also used to give fiefs out of the nationalized lands to those soldiers who agreed to the risky and boring duty of being border guards and settling in border towns. He gave fiefs to soldiers of that garrison, for instance, which stayed in the border port of Asqalan. The practice continued during Uthman’s time.139

The allotment of nationalized estates to political dignitaries, particularly Quraysh dignitaries, started during Uthman’s era. 140 Abdullah bin Mas’ud, Ammar bin Yasir, S’ad bin Waqqas, Usamah bin Zaid, and Zubair bin Awwam, were beneficiaries. 141 Certain tribal chiefs who had associated themselves with Islam during Prophet Muhammad’s time also got such allotments. Wā’il bin Ḥujr al Ḥadrami, Khabbab bin Aratt, ‘Adi bin Ḥatim of Tayy, Khālid bin ‘Urfuṭah, Ash’ath bin Qays of Kindah, Jarīr bin ‘Abdallah of Bajilah benefited from it. 142 We don’t know the exact reason behind Uthman’s decision. The point to note is that Ali is not included in the list of people who received estates at the hand of Uthman. Uthman and Abdur Rahman bin Awf never received any estates from Prophet Muhammad or from the Rashidun Caliphate. They were affording.143

Separate ownership of water and land

The canal irrigation system of Swad, Syria and Egypt, which was developed during pre-Islamic times, remained a government property of the Rashidun Caliphate. Other natural sources of water remained in private hands. ‘Ain ar Rūmiyah together with its spring, located in the Raqqah district, belonged to Walīd bin ‘Uqbah bin Mu’aiṭ. 144

Skills development

Widespread conquests, the bright chances of getting a government job, the demand for bookkeeping the newly acquired wealth, the zeal to learn the newly established religion, and many more things stimulated the Arab elite to be literate Ma’mar notes that Umar was illiterate at the time of conversion. 145 He developed his literacy skills later on.

Economic immigrants

Economic immigration continued throughout the decades of the Rashidun Caliphate. It was a government-encouraged movement and its basic direction was from the Arabian deserts to the remotest frontiers of the country. Once enough families had emigrated from mainland Arabia to the newly acquired regions of Syria, Iraq, Swad etc. The Medinite State provided incentives for Arabs of this region to immigrate further away towards borders. Probably, Rashidun Caliphate trusted in the loyalty of Arabs, even if they were non-Muslims.

During the tenure of Umar, Abu Ubayda the governor of Syria, settled Arabs in the cities he had conquered. They were Syrians but had accepted Islam. Then he picked immigrants who had come from the Arabian Desert, for example, Qays, and sent them to the frontiers. He stationed them there.146

When Mu’awiya was governor of Syria and Jazira, Uthman instructed him to settle Arabs in places far from the cities and villages and allow them to utilize uncultivated lands abandoned by anyone. Accordingly, he settled Banu Tamim at Rābiyah. He also settled ‘a promiscuous multitude’ of Qays and Asad and others in Māziḥīn and Mudaibir. He did the same thing in Diyār Muḍar. In like manner, he stationed the Rabi’ah in their Diyār. He stationed garrisons in frontier towns and gave them stipends. 147, 148

The Bedouin lifestyle didn’t become obsolete in Arabia as a result of the mass exodus. At least a few Muzaynah continued to peruse the traditional ways of life. 149

Prices

Not enough data is available to track price fluctuation during the Rashidun Caliphate and compare it with its precursor. As we have noted, a palm orchard was three hundred thousand Dirhams (30,000 Dinars) in pre-Islamic and early Islamic times in Arabia.150 During Umar’s time it is said to be worth one thousand Dirhams.151, 152 If so, the price of property had drastically dropped in Arabia by Umar’s time. Mass immigration of people away from Arabia after selling their properties explains the drop. The price of palm orchards might have dropped drastically as compared to other kinds of agricultural land. During Umar’s reign both Uthman and Mu’awiya bought pieces of agricultural land in Khaybar at a cost of fifty-one thousand Dirhams each.153, 154

The prices of luxury items definitely dropped due to their increased supply and contracted demand. 155 (All conquered areas provided them but only the Arab elite were willing to buy them). In the early years of Futuhul Buldan, the ornaments on the body of Jālīnūs were priced at seventy thousand Dirhams.156 The head gear of Rustam was estimated to be a hundred thousand Dirhams in the open market. 157 The rest of the ornaments on his body fetched a price of seventy thousand Dirhams.158 Later on, one precious high-end ruby fetched one thousand Dirhams during Umar’s time. 159 The prices of luxury items that the newly conquered lands lacked didn’t drop though. Uthman bought his racy horse from Miqdad bin Amr during his caliphate for thirty thousand Dirhams. 160 During the later years of the Rashidun Caliphate, the price of a slave dropped so much that trying to get ransom from his relatives became more economically feasible. 161 Muslim Arabs who freed their slaves under Umar’s orders got a maximum of five hundred Dirhams as compensation. 162, 163 That was the time the Arab market had started to be flooded by oversupply. An infertile woman slave of noble descent was sold for one thousand Dirhams in the early years of Umar’s caliphate.164

Military hardware, especially swords, had been in demand among Arabs. They were so fond of swords that they gave them proper names and kept track of their change of hands. Ibn Muljim bought his sword for five thousand Dirhams, with which he killed Ali. 165 Poisonous chemicals must be more expensive and difficult to find. Ibn Muljim paid four thousand Dirhams to buy the chemical he sprinkled on his sword.166

Al Ashtar had bought the camel for seven hundred Dirhams on which he transported Aisha to Medina. 167 Earlier, during Prophetic times, an ordinary camel was for only forty Dirhams.168 Either the price of the camel had skyrocketed due to an increase in travel demand around the country or Ashtar bought it urgently from the scene of the battle which was away from the markets.169.

The price of a garment was nine Dirhams in Kufa during Ali’s caliphate. 170 It was not much different from its price during Prophetic times.171

The prices of eatables had shot high during the famine in Hejaz. Umar’s servant bought a skin full of milk and a skin full of butter for forty Dirhams during those gloomy days.172

End Notes

- Sebastian Brock, “Syriac Writers from Beth Qaṭraye,” Aram 11.1 (1999): 85 – 96.

- Jacques Seigne, “A Sixth Century Water-Powered Sawmill at Jerash,” Annual of the Department of Antiquities of Jordan 26 (2002): 205 – 213. AND Oxford Studies on the Roman Economy: Capital, Investment, and Innovation in the Roman World. Ed. Paul Erdkamp, Koenraad Verboven, Arjan Zuiderhoek. (Oxford: Oxford University Press, 2020), 176, 177.

- Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XV, ed. Ehsan Yar-Shater, trans. R. Stephen Humphreys (Albany: State University of New York Press, 1990), 78.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 429.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 427.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 426, 427.

- Al-Imām abu-l ‘Abbās Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 29, 357.

- “Much money came to Abu Bakr from the mines of Qabaliyyah and Jhhayna (near Medina) and the mine of the Sulaym tribe was opened during the caliphate of Abu Bakr. He received alms money from it and deposited it in the treasury, thence distributing it to the people.” (ibn Sa’d 3.1.151)

- Sebeos, Sebeos’ History ed. and trans. Robert Bedrosian (New York: Sources of the Armenian Tradition, 1985), 47.

- vocabulary.com.

- Slavery is a relatively less researched topic. David Brion Davis is a leading historian on slavery in the USA. He has researched and written extensively on slavery. His first book, “The Problem of Slavery in Western Culture (1966)”, deals with the question of why slavery started in Judeo-Christian thought and why it became a sin in the late 18th century. His second book, “The Problem of Slavery in the Age of Revolution 1770 – 1823 (1975) demonstrates the contribution of slavery to the prosperity of the Anglo-American New World. In the second volume of this book, he shows that capitalist interests motivated the anti-slavery movement. His last book “The Problem of Slavery in the Age of Emancipation (1904)”, examines the rise of anti-slavery sentiments in the USA and England more elaborately.

- For an example of slaves working on agricultural lands see: Muhammad bin ‘Umar al-Wāqidī, The life of Muḥammad: kitāb al-Maghāzī, Ed. Rizwi Faizer, Trans. Rizwi Faizer, Amal Ismail and AbdulKader Tayob. (London: Routledge, 2011), 353.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 352.

- See above.

- Itzhak Fikhman, “Review of R. Bagnall, Reading Papyri, Writing Ancient History,” Scripta Classica Israelica 16 (1997): 279 – 285.

- Kyle Harper, “Marriage and Family,” in The Oxford Handbook of Late Antiquity. Ed. Scott Fitzgerald Johnson. (Oxford: Oxford University Press, 2012), 687.

- Muhammad bin ‘Umar al-Wāqidī, The life of Muḥammad: kitāb al-Maghāzī, Ed. Rizwi Faizer, Trans. Rizwi Faizer, Amal Ismail and AbdulKader Tayob. (London: Routledge, 2011), 353.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 340.

- For participation of slaves in Qadisiyyah from the Muslim side and nonpayment to them see: Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 772.

- Tabari gives the figures in camels. They are converted into Dirhams at a rate of seventy Dirhams per camel for the convenience of reading.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 433.

- Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. X, ed. Ehsan Yar-Shater, trans. Fred M. Donner (Albany: State University of New York Press, 1993), 189.

- Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XIII, ed. Ehsan Yar-Shater, trans. Gautier H. A. Juynboll (Albany: State University of New York Press, 1989), 124.

- Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XIII, ed. Ehsan Yar-Shater, trans. Gautier H. A. Juynboll (Albany: State University of New York Press, 1989), 36.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 232.

- Al-Imām abu-l ‘Abbās Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 24, 25.

- Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XIII, ed. Ehsan Yar-Shater, trans. Gautier H. A. Juynboll (Albany: State University of New York Press, 1989), 109.

- Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XIII, ed. Ehsan Yar-Shater, trans. Gautier H. A. Juynboll (Albany: State University of New York Press, 1989), 50.

- Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XIII, ed. Ehsan Yar-Shater, trans. Gautier H. A. Juynboll (Albany: State University of New York Press, 1989), 159.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 779. AND Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XIII, ed. Ehsan Yar-Shater, trans. Gautier H. A. Juynboll (Albany: State University of New York Press, 1989), 151.

- Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XIII, ed. Ehsan Yar-Shater, trans. Gautier H. A. Juynboll (Albany: State University of New York Press, 1989), 152.

- Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XIII, ed. Ehsan Yar-Shater, trans. Gautier H. A. Juynboll (Albany: State University of New York Press, 1989), 161.

- According to Juynboll, Ḥarrat Laylā was probably near Medina but the exact location is not known. See: Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XIII, ed. Ehsan Yar-Shater, trans. Gautier H. A. Juynboll (Albany: State University of New York Press, 1989), 161.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 788.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 201.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 201.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 429.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 88.

- See above.

- For the use of the word sadaqah in this sense during the Rashidun Caliphate see: Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 353.

- To see an example of the use of the word Ushr in this sense see: Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 353. Here Baladhuri writes that dhimmis paid Jizya and Muslims paid tithe.

- For a detailed study of the taxation system of Islam see: Jorgen Baek Simonson, Studies in the Genesis and Early Development of the Caliphal Taxation System, (Copenhagen: Akademisk Forlag, 1988.

- It is possible that a non-Muslim paid only Jizya in case his source of income was business or labour and not agricultural land.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 236.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 190.

- Figures are given in Dinar by Baladhuri. Dirhams are converted at a rate of ten Dirhams per Dinar for the convenience of the reader.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 102.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 111.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 123.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 429.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 429.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 429.

- For further details of rate of Kharaj in Swad see: Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 782, 783.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 426, 427.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 786.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 317.

- Al-Imām abu-l ‘Abbās Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 29.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 87.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 102.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 191.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 191.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 103.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 786.

- The Egyptians used to pay two Dinars per household as Jizya immediately after its conquest. (Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 777). While its rate elsewhere, for example in Armenia, was one Dinar per household. (Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 316).

- Currency of ex-Byzantine provinces was Dinar. Ya’qubi gives the tax figure of Egypt in Dinars. Dirhams are converted at a rate of ten Dirhams per Dinar for convenience of reading. One Dinar = ten Dirham. (Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 190).

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 767.

- The currency of ex-Byzantine provinces was Dinar. Ya’qubi gives the tax figure of Egypt in Dinars. Dirhams are converted at a rate of ten Dirhams per Dinar for convenience of reading.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 428.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 784.

- See above.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 782.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 87.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 776.

- See above.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 784.

- For statistics see: Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 784, 785.

- Alfred Grohmann, “Apercu De Papyrologie Arabe”, Etudes De Papyrologie, 1932, P 45 – 46, Vol. I.

- Alfred Grohmann, “Apercu De Papyrologie Arabe”, Etudes De Papyrologie, 1932, P 43 – 44, Vol. I.

- Alfred Grohmann, “Apercu De Papyrologie Arabe”, Etudes De Papyrologie, 1932, P 40 – 43, Vol. I.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 426, 430, 782.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 423.

- Theophanes the Confessor, The Chronicle of Theophanes, trans. and ed. Harry Turtledove, (Philadelphia: University of Pennsylvania Press, 1982), P 40, annus mundi 6131. See also: Walter, Kaegi E. Byzantium and the early Islamic conquests. New York: Cambridge University Press, 1992), 258.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 773. See also: Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XIV, ed. Ehsan Yar-Shater, trans. G. Rex Smith (Albany: State University of New York Press, 1994), 114.

- A. Grohmann, “Apercu De Papyrologie Arabe”, Etudes De Papyrologie, 1932, Tomme Premier, P 44. AND A. Grohmann, I Arabische Chronologie. II Arabische Papyruskunde, 1966, Handbuch Der Orientalistik, E. J. Brill: Leiden/Koln, Plate II:2. AND W. Diem, “Philologisches Zu Den Arabischen Aphrodito Papyri”, Der Islam, 1984, Volume 61, P 272. Accession No. P.Berol 15002.

- M. Kawatoko, “Archaeological Survey of Najran And Madinah 2002”, Atlal: Journal of Saudi Arabian Archaeology, 18 (2005): P 51, Plate 8.13 (A). number: MThLTh – 009.

- M. Kawatoko, “Archaeological Survery of Najran and Madinah 2002”, ATLAL: journal of Saudi Arabian Archaeology 18 (2005): 51 – 52. Plate 8.13 (A).

- Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XIII, ed. Ehsan Yar-Shater, trans. Gautier H. A. Juynboll (Albany: State University of New York Press, 1989), 66.

- Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XIII, ed. Ehsan Yar-Shater, trans. Gautier H. A. Juynboll (Albany: State University of New York Press, 1989), 66.

- Muharram is the first month in the Hijrah calendar.

- For coins of different designs issued by the Rashidun Caliphate see: H. Gaube, Arabosasanidische Numismatik, Handbucher Der Mittelasiatischen Numismatik Band II, Klinkhardt & Biermann: Braunschweig, 1973. See also: John Walker, A Catalogue of the Arab-Sassanian Coins, (London: The British Museum, 1941).

- For details see: Malek Iradj, etude de numismatique iranienne sous les Sassanides et Arabe-Sassanides II, rev. ed., (Paris, 1984).

- The coin was auctioned at New York. Current location unknown. S. Album & T. Goodwin, Syllogue of Islamic Coins in the Ashmolean – The Pre-Reform Coinage of the Early Islamic Period, Vol. I, (Oxford: Ashmolean Museum, 2002), 6 – 7.

- Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XVII, ed. Ehsan Yar-Shater, trans. G. R. Hawting (Albany: State University of New York Press, 1996), 231.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 235.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 430.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 782 footnote 1013.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916),

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 426.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 782.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018),762.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018),772.

- Ya’qubi gives figures in Dirhams. It is converted into Dinar at a rate of one Dinar for ten Dirhams for the convenience of the reader.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 780.

- The great Plague of Syria might have affected the consumer price index adversely.

- For the borrowing of Umar from the public treasury see: Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018),793. For Sa’d’s borrowing see: Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XV, ed. Ehsan Yar-Shater, trans. R. Stephen Humphreys (Albany: State University of New York Press, 1990),15. For Hindah’s borrowing see: Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XIV, ed. Ehsan Yar-Shater, trans. G. Rex Smith (Albany: State University of New York Press, 1994), 133, 134.

- Uthman compelled Sa’d to pay back after his dismissal. See: Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XV, ed. Ehsan Yar-Shater, trans. R. Stephen Humphreys (Albany: State University of New York Press, 1990), 17.

- Abdur Rahman bin Awf divorced his wife Tamāḍir bint Aṣbagh of the Kalb tribe when he became severely ill. Uthman declared the divorce null and void. (Goden feels that probably Uthman perceived the motive of divorce at deathbed to disqualify her of her due inheritance). She was given in the ensuing agreement a quarter of the eighth of Abdur Rahman’s inheritance. She between eighty to one hundred thousand Dinars. (Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 810).

- Al-Imām abu-l ‘Abbās Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 29.

- For the location of Shajrah see: Yāqūt Vol. III, pp 260 – 261.

- Al-Imām abu-l ‘Abbās Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 29.

- For the location of Yanbu see: Ya’qut, Vol. IV 1038 – 1039.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 813.

- Jean-Philippe Bouchaud and Marc Mezard, “Wealth Condensation in a Simple Model of Economy”, Physica, February 2000.

- Mark Buchanan, Harvard Business Review, April 2002. I did not try to get the correct citation or read it.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), Vol. I, P 36.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018),780. AND Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. X, ed. Ehsan Yar-Shater, trans. Fred M. Donner (Albany: State University of New York Press, 1993), 83 AND Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XII, ed. Ehsan Yar-Shater, trans. Yohanan Friedmann (Albany: State University of New York Press, 1992), 203.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 198.

- See above.

- Gift giving and its acceptance is a matter of active research in sociology. Generally, the research has established that the receiver of a gift understands the emotional value of the gift and assesses the love the sender shows by the value and utility of the gift as well as by the accompanying message. However, the recipients instantly discover if a gift is meant as a bribe and not as a gesture of love. See: Baskin E, Wakslak CJ, Trope Y, et al. Journal of Consumer Research. 2014; 41(1): 169 – 82. AND Flynn FJ, Adams GS. Journal of Experimental Social Psychology. 2009; 45(2): 404 – 9. AND Givi J, Galak J. Journal of Consumer Psychology. 2017; 27(4): 473 – 9. AND Teigen KH, Olsen MV, Solas OE. Br J Soc Psychol 2005; 44:125 – 44. AND Ward MK, Broniarczyk SM. Journal of Marketing Research. 2016; 53(6): 1001 – 18. AND Adams GS, Flynn FJ, Norton MI. Psychol Sci. 2012; 23(10): 1145 – 50.

- Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XIV, ed. Ehsan Yar-Shater, trans. G. Rex Smith (Albany: State University of New York Press, 1994), 73.

- Interestingly, Sariyah bin Zunaym had not provided any travel allowance to the messenger. He misread Umar so badly that he asked the messenger to borrow money from anybody in Basrah and pay it back out of the return gift he would receive from Umar on this auspicious occasion. Umar received the messenger with regards, fed him and enquired about the well-being of the soldiers on borders. As soon as Umar came to know about the gift, his tone changed. He called his servant in and asked him to give the messenger a slap on his neck. The servant, who probably did not have any sense of humour, really did it. The astounded messenger then divulged his next dilemma. He did not have transport to get back as he was relying on Umar’s gift. An angry Umar lent him a government-owned camel to return with instructions that he would give a free lift to anybody on the way to justify the use of government property. See: Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XIV, ed. Ehsan Yar-Shater, trans. G. Rex Smith (Albany: State University of New York Press, 1994), 73.

- Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XIV, ed. Ehsan Yar-Shater, trans. G. Rex Smith (Albany: State University of New York Press, 1994), 34.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 772.

- Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XV, ed. Ehsan Yar-Shater, trans. R. Stephen Humphreys (Albany: State University of New York Press, 1990),28. See also: (Walter, Kaegi E., Byzantium and the early Islamic conquests. New York: Cambridge University Press, 1992), 250.

- Tabari uses the word barīd for the postal system. The name might have its roots in a Byzantine Roman system whereby saddled horses used for the express post were called veredi. See: A. H. M. Jones, The later Roman Empire, 284 – 602: A Social Economic, and Administrative Survey, (Oxford: Basil Blackwell, 1964), 830 – 834. If actually so, it gives us an indirect clue that the system was adopted from Byzantine practices. See: G. R. Hawting, The First Dynasty of Islam, (London: Routledge, 2000), 64.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 786.

- Jar was a one-day journey from Medina.

- Ya’qūbī, Ibn Wāḍiḥ al-, The Works of Ibn Wāḍīḥ al-Ya’qūbī: An English Translation, Eds. and Trans. Matthew S. Gordon, Chase F. Robinson, Everett K. Rowson and Michael Fishbein, (Leiden: Brill, 2018), 786.

- Ṣikāk is the plural of ṣakk which is the origin of the word cheque/check in European languages.

- Abū Jā’far Muḥammad bin Jarīr al-Ṭabarī, The History of al- Ṭabarī. Vol. XIII, ed. Ehsan Yar-Shater, trans. Gautier H. A. Juynboll (Albany: State University of New York Press, 1989), 159.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 430, 431.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 431.

- Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 233, 234.

- Al-Imām abu-l ‘Abbās Aḥmad ibn-Jābir al-Balādhuri. Kitāb Futūh al-Buldān, ed. and trans. Philip Khūri Ḥitti, (New York: Columbia University, 1916), 23.